Businesses that suffer financial losses after a terror attack are to benefit from a legal loophole being shut.

They will now be able to get insurance even if they have not been damaged by a bomb. This means shops and businesses that are forcibly closed after an attack will be able to reclaim potentially big losses, so John Glen, the Economic Secretary to the Treasury, believes the changes would now mean that businesses have “peace of mind” if they ever were to be attacked.

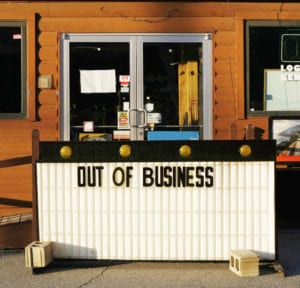

This cover comes from a government set up scheme that pays out insurers in the event of such a horrific attack. The scheme, named Pool Re, has paid out more than £1.3 Billion to insurers and businesses after 16 terror attacks. The loophole comes in when it was revealed that businesses indirectly affected by an attack don’t have to be paid any money, even if they have to close. For example when the London Bridge attack occurred, many businesses had to close (even though they weren’t actually attacked) because they were located in the area of the attack, and this area was closed for 11 days afterwards.

More than 100 merchants lost £1.5 Million as artisan traders were locked out of their premises. Food rotted and the popular restaurants surrounding the market had their shutters down at one of the busiest times of the year.